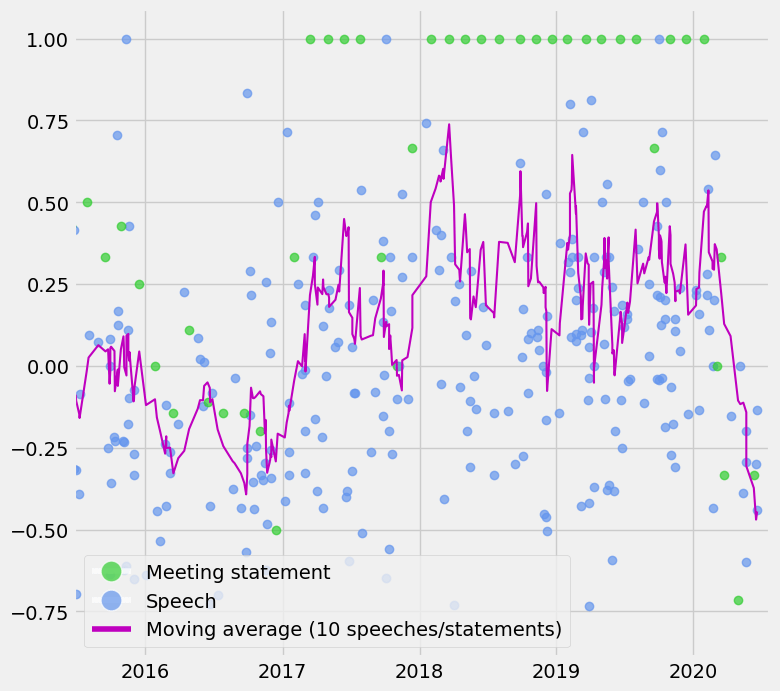

Every month has a different market flavor, from Chinese growth to easing of Federal Reserve policy. To illustrate this, I conducted natural language processing on daily market commentary. The result is a recap, for the last two years, of the various themes that the market has focused on.

Since 2023, we have seen the market fret about Chinese growth (summer 2023); over-anticipate Fed easing before paring back expectations (winter 23/24); focus on Japan as the Bank of Japan finally started hiking (spring 2024); analyze actual Fed easing (fall 2024); salivate on potential Chinese easing (winter 2024); and stress about tariffs (year-to-date).

We are now in the fourth month of tariffs being the main macro focus, and April thus far has seen a spike in the word “negotiation”.

Acknowledgements: The research I am analyzing is by BNZ, who leverage their timezone vantage point — as the first to see the trading day open — by producing a thorough recap of the previous day.

Method: I used my own Python code to load the reports, extract text from them, omit generic words like “the” and “lower”, count the most common words for every month, and use a mix of rules to determine every month’s macro meme. The code did all of this — over 500 reports to parse — in 178 seconds. You can contact me if you would like to see my code.