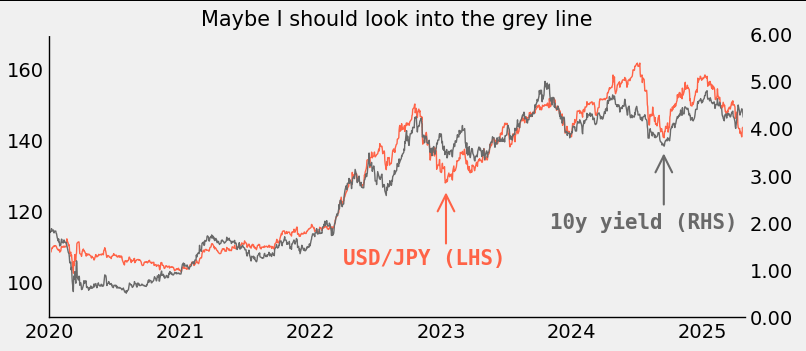

Bonds issued by the US government, known as US Treasuries, sit at the center of the world’s financial constellation. What happens to Treasuries ripples through to every other market: bonds of other countries, stocks, FX, and crypto. Sure the FX market is larger, but the dollar takes its cues from US Treasury yields.

My raison debt. Given the importance of the key 10-year yield, I have modeled it as a function of macroeconomic and financial data (i.e. inflation, issuance at auctions, rainfall in Ohio, etc…). The result is a reliable fair value estimate of the 10y yield, but also a framework to evaluate the importance of new data: yes, the jobs numbers came in weak, but what does that mean for the 10y yield in basis points?

It works. A measure of the model’s success is that it has produced 10 major recommendations in the last four years, and 9 of them have worked, producing over 500 basis points in returns.

The model produced prescient paid recommendations in 2022 (high inflation) and 2023 (SVB), and received recommendations in 2025 (expectations for Fed cuts; still live).

How does it work? At the core of the model is a fair value estimate for the 10y yield, itself a blend of key macroeconomic and financial data. Independent variables are smoothed, regressed, and weighted. In addition to that, I apply a valuation filter that dictates the actual execution of the model.

An honest backtest. The above model was trained on 2017-2021 data. I then backtested it out-of-sample from 2021 onwards, and this has produced the >500bp in returns.

Current model recommendation: Receive 10y (yearend forecast of 3.50%). The model lives here.